Many of my collector friends talk about the difficulties they face when calling up customers to remind them about their payment dues – unanswered calls, rude responses, lame excuses, partial payments, bankruptcy scenarios, and more.

But something that is seldom talked about is the cost of collecting the revenue. As the revenue or invoice ages, the cost of collecting it increases while the probability of bad debt rises.

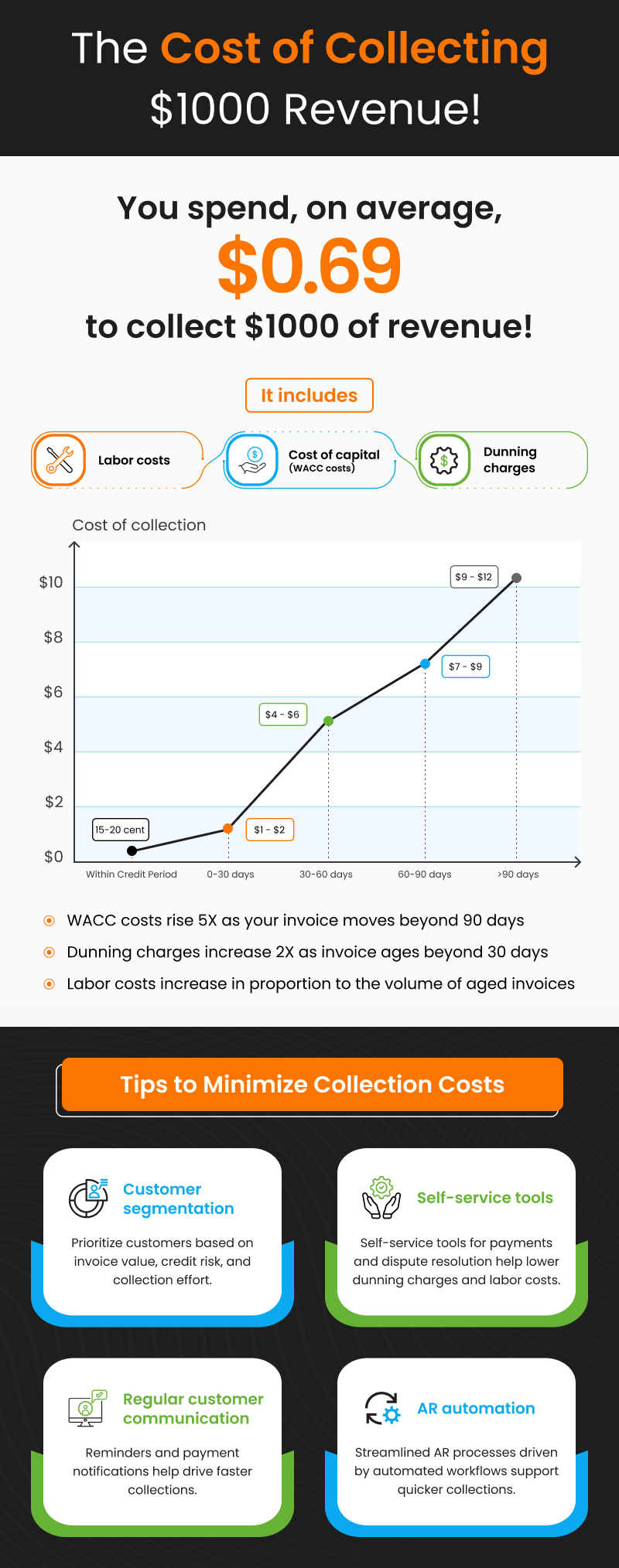

Today, we look at how many $$$ it takes to collect one thousand dollars of your revenue.

To receive more such interesting insights, right in your inbox,

The cost of collecting one thousand dollars of revenue, on average, is…

… a mere $0.69 cents!

Here this $1000 of revenue is assumed to be spread across different aging buckets – within the due date, 0-30 days, 31-60 days, 61-90 days, and 90+ days.

But as more proportion of your revenue gets saddled in the 30+ days brackets, the cost of collecting the $1000 skyrockets. The cost of collections increases by almost 50X once the amount becomes 90 days overdue.

The increase in costs is driven by a rise in:

Weighted Average Cost of Capital (WACC) expenses

Dunning Charges

Labor Costs

While dunning and labor costs tend to plateau once the invoice reaches 60 days overdue, WACC costs continue to rise exponentially (200%+) as your business is dependent on external capital (at a higher interest rate) in the absence of the expected cash inflows.

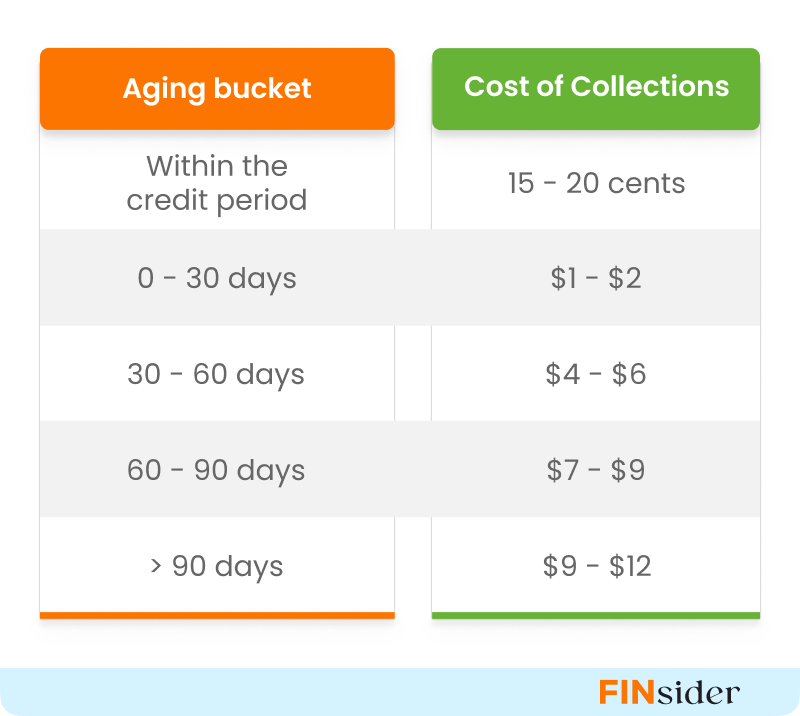

Here’s a table capturing the costs of collecting $1000 revenue across different aging buckets.

For more detailed research on the cost of collections, click here.

Tips to minimize the cost of collections

Here are key recommendations from financial experts to collect invoices promptly and minimize the cost of collections and working capital.

Customer segmentation and prioritization:

Prioritize high-risk accounts with larger outstanding amounts.

Focus efforts on significant unpaid invoice values for better returns.

Customer self-service tools:

Businesses providing payment and dispute resolution self-service tools experience lower collection costs.

These tools streamline communication, send notifications, and aid invoice organization.

Regular customer communication:

Communicate with clients before invoices become overdue.

Send automated reminders before and after due dates to prevent missed payments.

Streamline AR processes with technology:

Collaborate across collection, credit, and sales teams for lower costs.

Centralized information facilitates coordinated decisions on sales, credit terms, and trade discounts.

Automation through AR software expedites workflows and ensures robust credit risk assessment.

Summarizing the cost of collections in an INFOGRAPHIC

Read the full story on our website