The king of AI chips, NVIDIA's financial agility shines with a strategic supplier relation, and efficient inventory turnover, positioning it as a top player in the semiconductor industry.

📊 Here’s what their O2C metrics look like:

101 days average CCC

8 days lower DSO against competitors

22% faster DIO than competitors

2x faster DPO than competitors

With rivals hunting for its AI crown, can NVIDIA still tighten the screws on working capital?

Let’s deep dive into whether NVIDIA can fend off its challengers! 🔎

NVIDIA's revenue skyrocketed by 265% 🚀

NVIDIA's stock price hit a record high of $522 per share, surging 6.4% in a single day and skyrocketing over 230% in the past year. This surge is expected to boost NVIDIA's financials.

💡 Let's explore recent stock updates at NVIDIA and their financial impact:

1. Revenue Surge: In Q1 2024, NVIDIA reported a 265% annual revenue increase, hitting $22.1 Bn. This growth stemmed from AI-driven innovations and high demand for its top-tier AI chips.

2. Data Center Expansion: NVIDIA's data center segment, its largest revenue contributor, experienced remarkable growth with its sales spiking by 409% (to $18.4 Bn) in the last fiscal quarter.

3. Market Capitalization Rise: Following NVIDIA's earnings announcement, a surge in stock pushed its market cap up by over $129 Bn.

4. Supply Chain Challenges: Despite improvements, NVIDIA's CEO, Jensen Huang, acknowledged ongoing difficulties in meeting the surging chip demand.

NVIDIA's CCC stands at 101 Days 🔁

From 2020 - 24, NVIDIA’s cash conversion cycle (CCC) has been averaging around 101 days.

In 2023, its CCC rose to 133 days, suggesting possible challenges in financial management.

As NVIDIA dealt with this, its competitors AMD and Intel gained attention; AMD had a CCC of 129 days, while Intel had a low CCC of just 60 days.

Now, let’s look into its Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), & Days Inventory Outstanding (DIO) metrics to understand better what drove these CCC scores!

NVIDIA DSO is 8 days lower than the industry 📉

Over the past five years, NVIDIA’s Days Sales Outstanding (DSO) averaged 41 days, significantly below the industry’s 49-day average.

In 2023, its DSO increased to 57 days while AMD’s stood at 63 days, highlighting NVIDIA’s ability to manage receivables and cash flow.

💡 Know how NVIDIA consistently maintains steady DSO levels here.

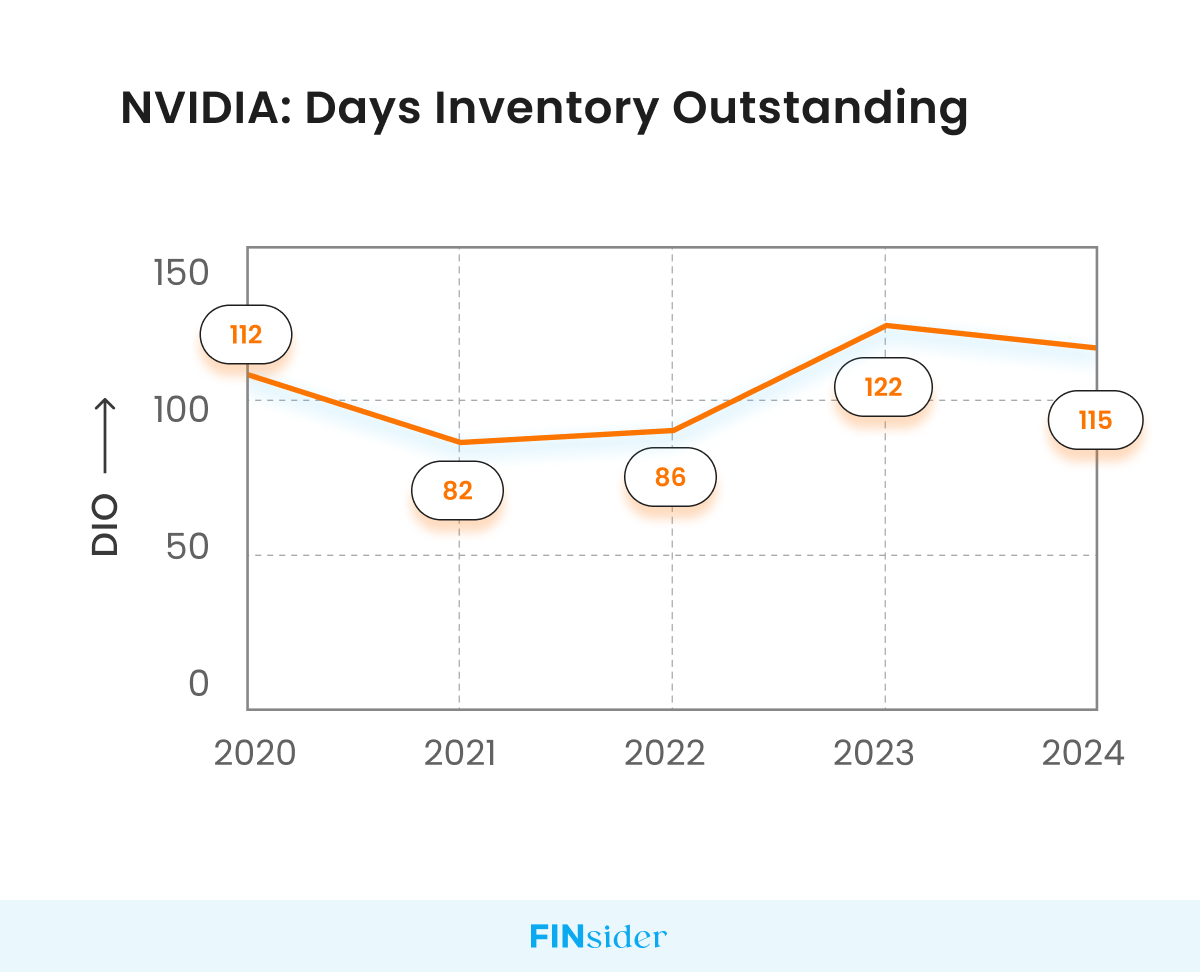

NVIDIA clears inventory 22% faster than its peers 📦

NVIDIA’s Days Inventory Outstanding (DIO) averaged 103 days over 2020-2024, outperforming the industry average of 125 days. Consistent DIO levels indicate robust supply chain management.

In 2023, NVIDIA’s DIO at 122 days surpassed rival Intel’s 136 days, showcasing superior inventory turnover efficiency.

💡 Know how NVIDIA maintains a lower DIO than its peers here.

NVIDIA pays suppliers 2x faster 💰

Over the past five years, NVIDIA has consistently maintained a low Days Payable Outstanding (DPO) of around 50 days, showcasing effective supplier relations and payment management.

In 2023, NVIDIA’s DPO improved to 47 days, indicating efficient payment processing.

Intel’s DPO stood at a notably higher 102 days, highlighting NVIDIA’s superior management of supplier relationships and payment timelines.

💡 Learn how NVIDIA keeps a good relationship with its suppliers here.

Mining Millions: NVIDIA Ahead in the Cash Race 🥇

Despite supply challenges, NVIDIA has optimized inventory management, quick sales, and payments, revolutionizing industries with graphics and AI technologies.

At its 2024 conference, over two dozen new AI tools targeted drug discovery, surgery, and medical imaging.

As NVIDIA mines opportunities in AI and healthcare, will it maintain its lead in converting chips to cash? For now, NVIDIA’s formulas have it maintaining millions through a diversifying portfolio.

📖 Check out our latest April Edition here!