How good is bad debt? Unearthing Fortune 1000's Losses

25% YoY growth in bad debt, 6% YoY growth in AR, & more!

Bad debt is a silent profit killer, quietly draining your company's revenue. But how much are businesses truly losing due to unpaid invoices?

In this article, we’ll explore the revenue losses of the top 50 Fortune 1000 companies across key industries, highlighting the impact of bad debt. The findings include:

6.94% YoY growth in accounts receivable CAGR

25.68% YoY CAGR growth in bad debt

1.49% average bad debt-to-sales ratio in 2023

10.55% average bad debt-to-accounts receivable ratio in 2023

Is your company unknowingly losing millions to bad debt? What steps have Fortune 1000 companies taken that you can implement before it's too late? Let’s find out.

Bad Debt: A small leak that sinks big ships 🚢

We analyzed three major U.S. industries—Manufacturing, Healthcare, and Technology—focusing on the top 50 Fortune 1000 companies. To assess the impact of bad debt, we examined two key metrics:

Bad debt-to-sales ratio: Percentage of sales lost to unpaid invoices

Bad debt-to-accounts receivable ratio: Share of receivables deemed uncollectible

Companies in the 75th percentile maintain a Bad Debt-to-Sales Ratio of 0.1% or lower 📝

The 2023 bad Debt-to-Sales ratio highlighted stark differences:

Top performers (75th percentile): Ratios of 0.1% or less

Low performers (25th percentile): Ratios of 0.57% or higher

Average ratio: 1.49%, surpassing both thresholds

While these percentages appear small, the financial impact is significant. For a company with $1B in sales, a 1% ratio equals $10M in losses, and cutting it by just 0.01% could save $100,000!

Companies in the 75th Percentile maintain a bad Debt-to-Account Receivables ratio of 0.7% or less 🎯

The analysis reveals wide gaps in managing accounts receivables and bad debts:

Top performers (75th percentile): Ratios ≤ 0.7%.

Low performers (25th percentile): Ratios ≥ 4.32%.

Average ratio: 10.55%, skewed upward by a few companies with extremely high ratios.

The average ratio of 10.55%, well above high and low performer thresholds, suggests a few outliers with extremely high ratios skew the results.

Grow fast but not at the cost of bad debt 📈

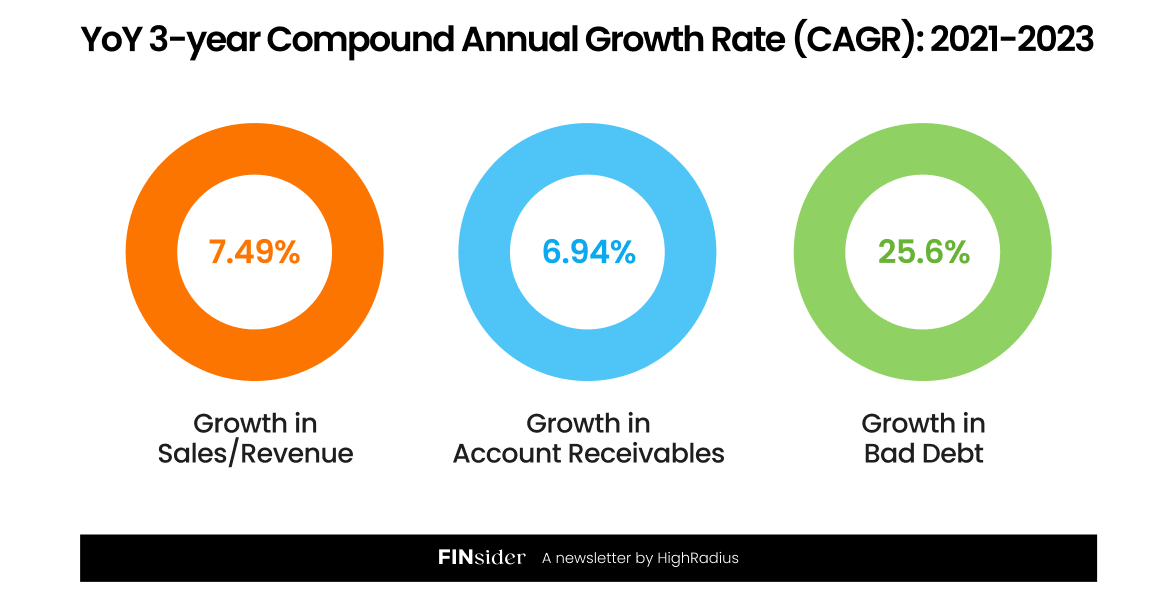

From 2021-23, companies showed a 7.49% CAGR in sales revenue, reflecting strong growth, and a slightly lower 6.94% CAGR in accounts receivable, indicating effective collection management.

However, a 25.6% CAGR in bad debt stands out, raising concerns about credit management and customer financial health. These trends warrant a closer look at industry-wide data.

Industry-wise analysis of Bad Debt Ratios 📊

Technology: Receivables grew 9.2% YoY, with bad debt-to-sales rising 0.02 points to 1.38% and bad debt-to-receivables up 0.15 points to 2.28% in 2023.

Manufacturing: Accounts receivable grew 8.1% YoY, with a 2023 bad debt-to-sales ratio of 0.07%–1.37%, up 0.03 points from 2022. The bad debt-to-receivables ratio rose 0.13 points in the same period.

Healthcare: With bad debt-to-sales ratios ranging from 0.25% to 55.49% and a 2023 average of 5.15%, the industry was an outlier. Pandemic-era collection moratoriums significantly impacted bad debt expenses and write-offs.

High Performers' Bad Debt Mitigation Strategies 💡

Diversify credit risk: Use dashboards to monitor AR concentration and disclose if any customer exceeds 10%.

Assess risk regularly: Leverage third-party data and credit models to evaluate customer health.

Enforce credit controls: Require letters of credit, guarantees, and proper onboarding documentation.

Predict risks proactively: Use real-time monitoring and models to forecast delinquencies.

Streamline workflows: Implement electronic systems for faster, accurate credit decisions.

Enhance collections: Use dedicated teams, self-service portals, and robust support for efficient payments.

The Road Ahead: Taming the Bad Debt Beast 🚀

With higher interest rates and tighter credit conditions, bad debt will be an increasing challenge.

By benchmarking bad debt ratios and refining credit policies, businesses can minimize their impact and grow smart, not just fast.

This story is a part of our latest November edition.