6 must-watch priorities every CFO should know in 2025

As we move through 2025, CFOs are navigating a landscape of rapid technological change, economic uncertainty, and expanding corporate responsibilities.

A recent Gartner survey of 250 CFOs identified seven key priorities shaping financial strategy this year, including:

35% of CFOs struggle with data quality for AI

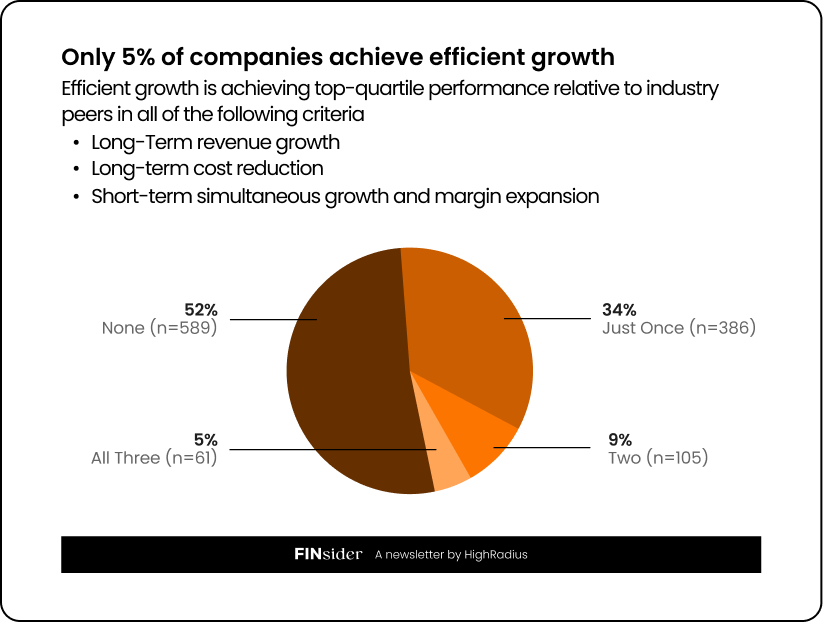

5% of companies achieve efficient growth

58% of finance teams piloted AI in 2024

77% of CFOs face AI talent shortages

Curious to know which actions CFOs can take to address them effectively? Let’s find out together.

1. 35% of CFOs Cite Data Quality as a Major Roadblock

Over 35% of CFOs cite data quality as the biggest hurdle to AI adoption in finance, while 75% now oversee enterprise-wide data and analytics.

Bridging governance between financial and non-financial data is essential, yet siloed data management often results in inconsistency, duplication, and integration challenges.

💡 How can CFOs solve this problem?

Establish enterprise-wide data governance: Assign ownership roles and eliminate redundant data silos.

Invest in data analytics infrastructure: Ensure seamless integration of structured (financial) and unstructured (customer, operational) data.

Use finance’s unique role: Leverage finance’s cross-functional visibility to enforce standardized data practices.

Draft a Data Governance Charter that outlines accountability, key datasets, and governance mechanisms to ensure consistency.

2. Only 5% of elite companies are successfully achieving efficient growth.

💡 How can CFOs solve this problem?

Classify costs strategically: Distinguish between differentiating costs (drive unique value), enabling costs (essential but not competitive), and commoditizing costs (minimize).

Adopt long-term cost models: Companies with cost structures aligned to strategic differentiation see a 42% improvement in long-term value realization.

Think beyond traditional cost-cutting: Avoid excessive spending on “keeping up with competitors” and focus on optimizing costs that directly impact differentiation.

3. Finance Teams See 58% Surge in AI Adoption

AI adoption in finance surged from 37% in 2023 to 58% in 2024. However, most CFOs underestimate AI costs by 500%–1,000%, causing budget constraints and unrealistic ROI expectations.

💡 How can CFOs solve this problem?

Prioritize high-impact AI use cases: Start with intelligent automation (invoice processing, anomaly detection, predictive cash flow forecasting).

Address the 4 AI deal breakers: Ensure the organization has the necessary skills, enabling technologies, data availability, and staff acceptance before scaling AI projects.

Set realistic AI budgets: Plan for AI implementation costs, including infrastructure, training, and long-term operational expenses.

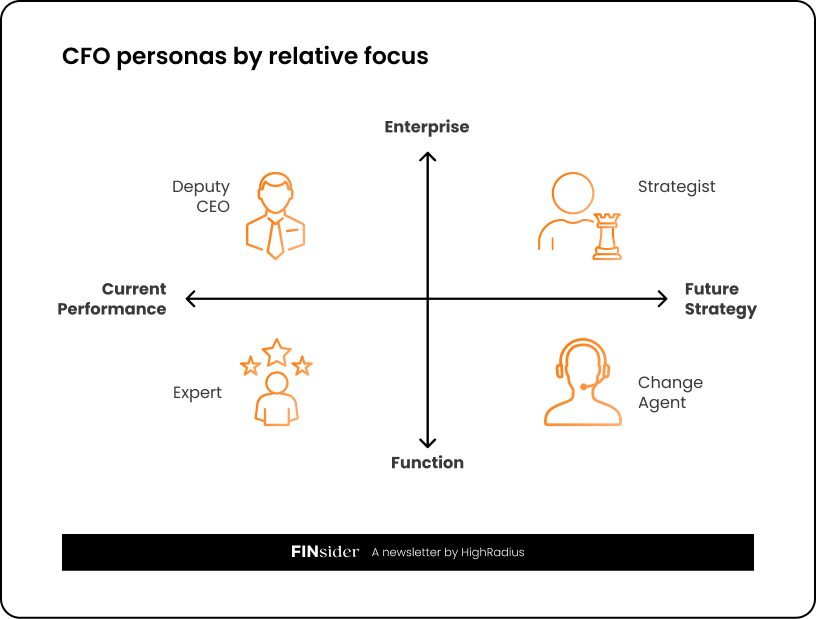

4. 70% are expanding the CFO role beyond finance

💡 How can CFOs solve this problem?

Define your CFO persona: Define if you are future-focused, a business performance manager, a transformation leader, or a technical finance leader.

Allocate time based on strategic priorities: Structure your schedules based on your leadership persona to be more effective in navigating role complexity.

Empower finance leaders to take ownership: Delegate operational responsibilities to strong finance VPs and focus on high-impact strategic work.

5. 77% of CFOs say their teams lack digital skills, hindering AI progress

Digital talent is both scarce and expensive—it is 63% more likely to be looking for other jobs and 69% costlier to replace than core finance talent.

💡 How can CFOs solve this problem?

Develop internal AI talent pipelines: Focus on AI-adjacent competencies like statistics, database querying, and data visualization.

Position upskilling as career growth: Employees are more likely to embrace digital training when framed as career progression rather than a mandatory learning exercise.

Leverage hands-on training: Give employees real-world AI projects (e.g., automate cash forecasting) rather than just theoretical learning.

6. Digital finance employment is set to grow by 50% by 2027

By 2027, half of all finance employees will be “digital talent”, meaning they will need to work with AI, automation, and advanced analytics.

Challenge? Currently, only 20% of finance teams have sufficient digital expertise, leading to a critical talent shortage for AI-driven finance functions.

💡 How can CFOs solve this problem?

Reimagine finance hiring strategies: Instead of hiring only traditional accountants, look for hybrid finance-tech profiles.

Enhance cross-functional collaboration: Digital finance teams must work closely with IT, data science, and business units.

Automate low-value workflows: Free up finance professionals to focus on high-impact strategic initiatives rather than manual number-crunching.

3 Key Moves CFOs Must Make in 2025

To master these six priorities, CFOs should take 3 immediate actions:

Launch a data & AI governance council: Establish a dedicated team responsible for data governance, AI adoption, and analytics standardization across finance.

Implement a cost-structure overhaul: Classify costs into differentiating, enabling, and commoditizing categories, then align capital allocation accordingly.

Create a digital talent retention strategy: Invest in AI training, provide clear career paths, and integrate automation to ensure finance talent is future-ready.

Final Thoughts: The CFO’s Expanding Role in a Data-Driven World

The modern CFO has evolved from a financial steward to an enterprise-wide leader, managing growth, AI, data governance, leadership capacity, and digital transformation.

By leveraging these seven data-driven insights, CFOs can navigate 2025’s challenges and build a finance function that drives long-term success.

What’s your next move? Assess your finance team’s priorities and take the first step toward transformation today.