Walmart vs. Amazon: Who Is the King in Cash Management?

5x faster cash collection, 3x longer CCC, 30% higher DIO & more!

Hey, FINsiders! 👋🏻

They are the two most successful global retailers today - Amazon and Walmart. Their competing approaches to order-to-cash will surprise you.

Walmart wins on payment collections - 5x faster. But Amazon keeps cash in hand longer - 18 days more than their rival.

So, why does each business pursue its separate objectives, and what does this mean? Let’s find out! 🕵🏻♂️

Walmart Collects 5x Faster than Amazon 🚀

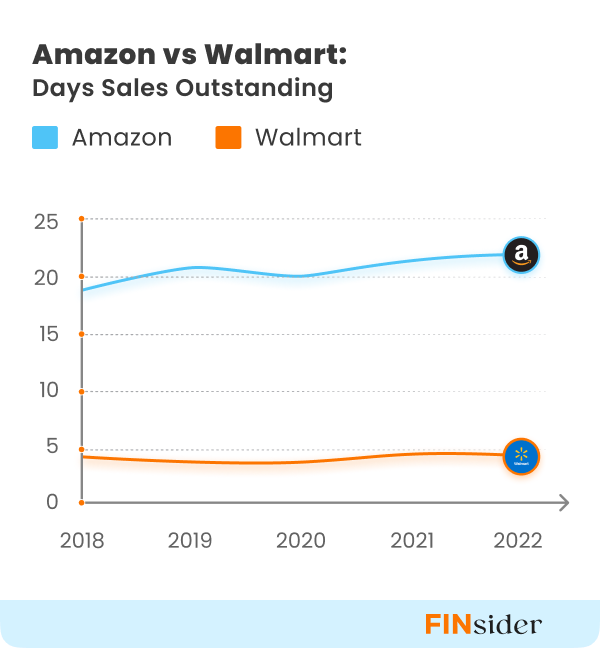

Walmart collects its Accounts Receivables (AR), on average, in just 4 days while Amazon takes 21 days.

Days Sales Outstanding (DSO) is the term used to indicate the average number of days a business takes to collect its AR.

The lower DSO for Walmart is largely because of its brick-and-mortar model that drives payment collection, mostly in cash, at the sales counters.

On the other hand, Amazon relies mostly on its e-commerce unit for its revenue. Amazon, hence, needs to wait till the delivery of the products or bank clearance to realize cash.

This makes the comparison not really an apple-to-apple one. Nevertheless, Walmart scores better on DSO, a key working capital metric.

The shorter DSO also enables Walmart to have a higher receivables turnover ratio than Amazon.

Walmart’s average receivables turnover ratio during the last five financial years was an impressive 88, against Amazon’s 18.

Walmart, essentially, collects payments 5X faster than Walmart.

Amazon gets to keep cash in hand for longer 💰

Though Amazon has a longer DSO, it has a negative cash conversion cycle.

A shorter Cash Conversion Cycle (or a negative one) is better as it implies the business can sell goods faster and collect the payments.

Amazon’s Cash Conversion Cycle, averaged -13 days for the last five financial years. For Walmart, it was 4.5 days.

Let’s delve into the reasons behind it.

1. Walmart’s DIO is 30% higher than Amazon’s

Days Inventory Outstanding (DIO) is the average number of days a business holds inventory before selling. So, the shorter your DIO, the better it is.

Amazon’s average DIO in the last five years was 30 days compared to Walmart’s 41 days.

Amazon does not hold large quantities of the inventory by itself. Instead, most products are shipped directly from third-party sellers, about 82% of its total sales.

Walmart, on the other hand, holds 1.6X times more inventory than Amazon. This increases its DIO.

2. Amazon has significant influence over its sellers and suppliers

Amazon’s dominance in online retail and its faster inventory turnover enables it to pay suppliers much later after collecting from customers. Amazon’s average Days Payable Outstanding (the average number of days it takes to pay suppliers) in the last five years is 62 days against Walmart’s 42 days.

This enables Amazon to hold cash in hand for longer, and hence essentially be financed by suppliers!

On a similar note, Amazon’s accounts payable turnover ratio (an indicator of how quickly a company makes payments to its suppliers) averaged 4.8, almost 35% lower than the industry average of 6.5.

Walmart on the other hand, pays suppliers almost twice as quickly as Amazon. Its payable turnover ratio was 8.4.

The Battle for the Retail Crown Is Far From Over 🥊

It’s difficult to predict who’ll win the battle between Amazon and Walmart. Amazon has rapidly grown in the last 5 years, doubling its revenue. During the same period, Walmart’s revenues grew only 20%.

But Walmart still leads Amazon in terms of overall revenue, $611 billion vs $514 billion (Amazon’s revenue excluding AWS is only $434 billion).

Amazon also boasts of almost 6X the cash and cash equivalents held by Walmart. Its operating cash flow for the latest financial year was 2.3x that of Walmart.

They are also foraying into each other’s core territories; Amazon into brick-and-mortar stores and Walmart into e-commerce.

The battle for supremacy between the two retail titans is ongoing with Amazon currently seeming to have an edge over Walmart as it accelerates its pace of growth.

Check out more details here.