85% of CFOs face talent gaps, putting them in the ‘hot seat’

What happens when CFOs run low on talent and high on pressure?

What happens when CFOs run low on talent and high on pressure? For many finance leaders, this isn’t a hypothetical, it’s their reality in 2025. Even as more students trickle into accounting programs, the pipeline remains narrow, and the stakes only grow higher. Here’s how today’s CFOs are adapting with a blend of technology and transformation, and what it means for the future of finance.

The Talent Shortage Is No Longer a Forecast, It’s Here

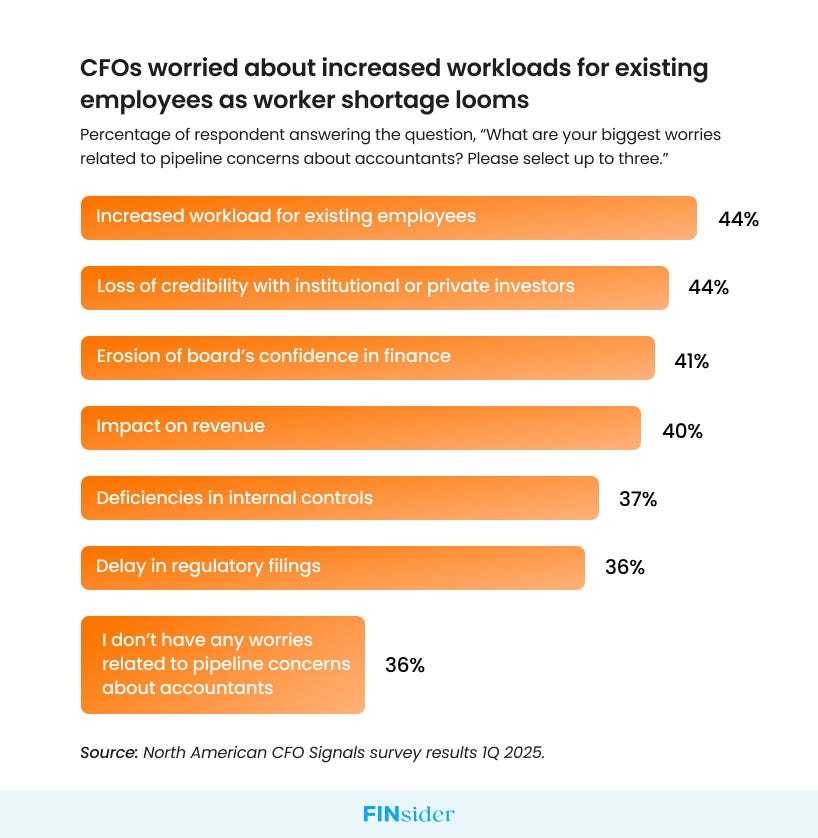

A recent Deloitte survey reveals that 85% of CFOs at large North American firms report a shortage of accounting and finance talent. This isn’t just a hiring hiccup; it’s an operational risk that can derail everything from daily workflows to boardroom confidence. Here’s what they’re facing:

More work for fewer people. A heavier workload raises burnout risk and drags down efficiency.

Eroded credibility. Understaffed teams can’t keep pace with investors’ and boards’ high expectations.

Strategic demands. As finance shifts from bookkeeping to strategic forecasting and risk analysis, talent gaps become glaring.

When fewer hands are around to manage complex tasks, the finance function slows down, and CFOs feel the heat. They’re expected to deliver insights, forecasts, and compliance, but without enough skilled staff, they may struggle to keep the engine running smoothly. To read the full story, click here.

Generative AI Isn’t Tomorrow’s Fix, It’s Today’s Priority

Nearly 80% of CFOs plan to deploy generative AI to close the skills gap within the next two years, a massive jump from just 9% in 2024. AI promises to automate menial, time-consuming tasks like data entry, giving lean teams room to focus on strategy and high-value analysis. More advanced “agentic AI” systems can even explore data on demand, generating insights with minimal human input.

But AI isn’t a plug-and-play solution. To make it work, finance teams must tackle:

Integration challenges. Merging AI tools with existing ERPs and workflows can be tricky.

Security concerns. Sensitive financial data demands ironclad protections.

Building trust. Teams worried about job loss or overwhelmed by new tech can resist adoption.

Without buy-in, even the most advanced AI may sit idle. CFOs must act as both tech evangelists and culture champions, showing how automation can elevate human roles rather than replace them. Read more such CFO stories

Resistance to Change: AI’s Biggest Obstacle

Almost 50% of surveyed CFOs say their teams resist new technology, including AI.3 This cultural hurdle often proves more daunting than any technical issue. Introducing AI isn’t just a software upgrade, it’s a mindset shift. Employees might fear:

Job displacement. Will AI cut their roles?

Steep learning curves. Can they master new tools quickly?

Loss of control. How much autonomy will AI take away?

To overcome these fears, CFOs have to communicate clearly about AI’s benefits, streamlined processes, less drudgery, and more time for strategic thinking. Partnering with HR and IT to offer training, transparent roadmaps, and pilot programs can turn skeptics into supporters.

Rethinking Where and How to Find Talent

With traditional pipelines drying up, one-third of CFOs are now recruiting from other departments, marketing, operations, and even IT. This shift reflects the evolving demands of finance: today’s roles require data literacy, strategic insight, and technical savvy, not just accounting expertise.

Pulling from nontraditional backgrounds can be a game-changer:

Fresh perspectives. Marketing pros bring customer insights; IT brings tech fluency.

Versatility. Cross-functional experience helps teams adapt faster.

Culture fit. Candidates who already understand your organization may onboard more smoothly.

CFOs are stepping into talent-acquisition roles, becoming workforce architects who blend finance expertise with people skills. They’re redefining what a “finance team” looks like and what it can achieve.

The CFO of Tomorrow: Workforce Architect, AI Integrator, Frontline Strategist

Today’s CFOs aren’t just number crunchers; they’re strategists who must balance tight budgets, tech rollouts, and team morale. The accountant shortage has forced a reckoning and opened the door to reinventing finance leadership.

Technology as a lifeline. AI and automation help smaller teams do more.

Culture is the bedrock. Building trust and transparency boosts adoption.

Talent as a mission. Recruiting beyond traditional finance roles creates agile teams.

So here’s the question: As AI rises and talent models shift, will your finance team adapt fast enough, or will it fall behind the curve? To read the complete story, click here.